One evening in 1997 Ron Dizy went to the Gourmet Food and Wine Show in Toronto with a group of friends. After leaving they headed to a joint on Front Street to keep the party going and, a few drinks in, decided it was time to do flaming shooters off the bar. They asked some women, who’d also been at the show, to join them. Jo Ann Babcock, a woman with long curly red hair, spoke her first words to Ron: “Just don’t light my hair on fire.” When the evening finished, on the taxi ride home, Ron turned to a buddy and said, “That’s the woman I’m going to marry.” Three years later they were married. To a certain degree the randomness in that story underpins Ron’s life, an infinitely curious person open to the possibilities, the best the world has to offer, always willing to walk through the next door.

I met Ron when I attended my first meeting of something called the Corporate Partner’s Committee, an advisory group set up by the Ontario Energy Association to provide entrepreneurial insight into the Smart Grid Forum, a larger advisory group to Ontario’s Independent Electric System Operator. Yes, I understand, that’s a mouthful of organizational names. Imagine breaking it down into acronyms: OEA’s CPC’s purpose is to advise the IESO’s SGF. (Scary thing is, that sentence would make sense to some people, so welcome to Ontario’s energy market where I spent thirty years of my working life.) Anyway, after attending monthly meetings for a period of time, Ron, who was the committee’s chair, asked me to be vice-chair. The only reason I can think of is I was the one person who never missed a session; I could always chair a meeting if he was late or couldn’t make it. At the time, Ron was President and CEO of ENBALA Power Networks — but to me a breath of fresh air. Open, engaging, humorous to the point of irreverence, he had remarkable insights into the evolving energy market and yet was often noted for the crazy colourful socks he wore. What can I say, he was my kind of guy.

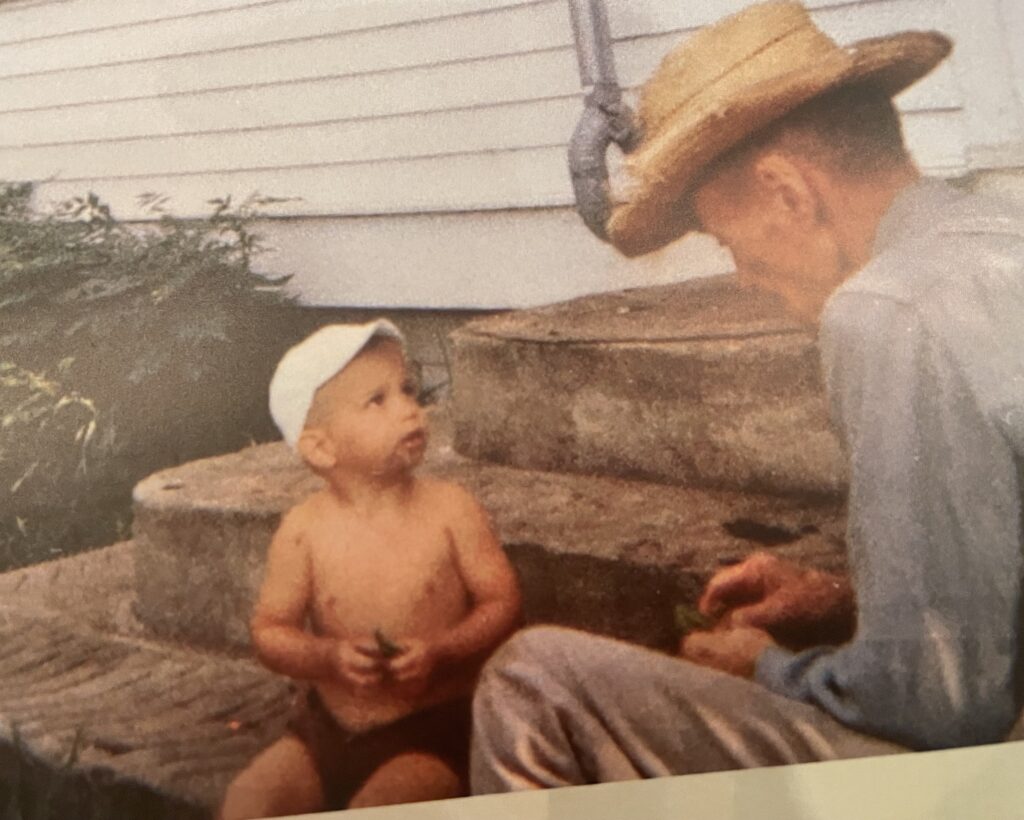

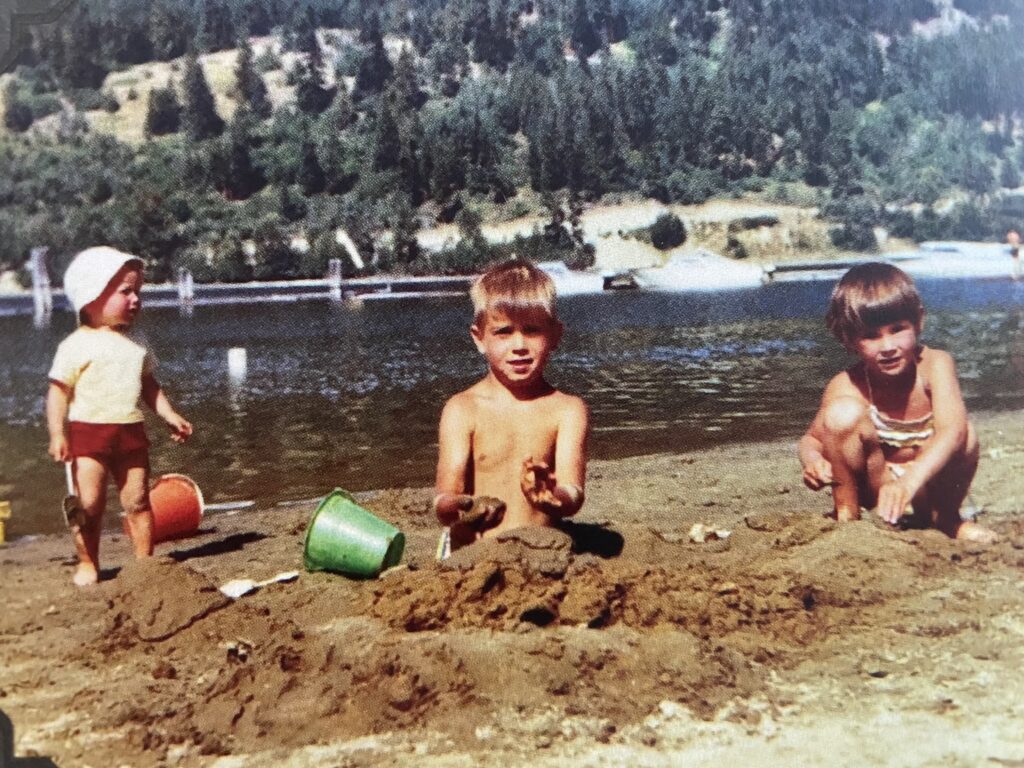

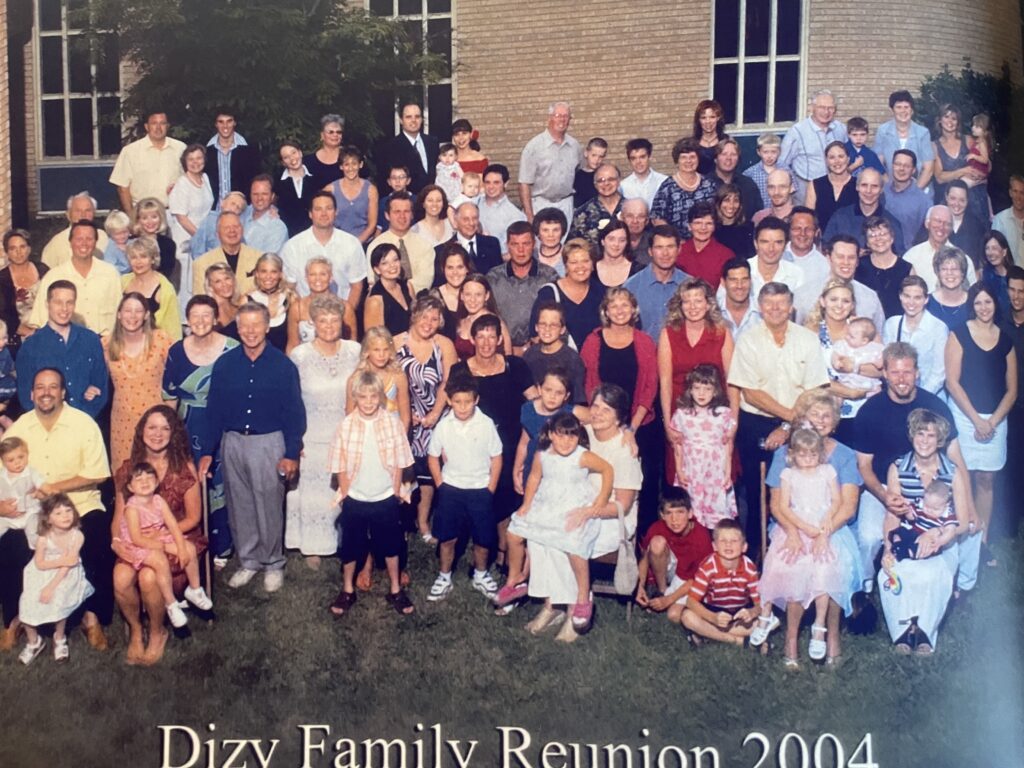

Ron Dizy (pronounced dee-zee) was born in Edmonton, Alberta on December 29, 1964, his parents first child and only boy. He has two younger sisters, Carol and Leanne, a rather small family of three kids given their parents’ background. After the Second World War ended, his father, Gene, the second oldest of fifteen children, emigrated to Regina, Saskatchewan from Holland along with two brothers. The plan was to get situated so that the entire family could come over. They succeeded although one brother decided to remain in Europe. Unable to speak English, Gene was supported by a local church who hired him as a bookkeeper. Eventually, after learning the language, he ended up in Edmonton, finding work with Imperial Oil, a company he stayed with for the rest of his working life. Helene Godin, Ron’s mom, had also left Saskatchewan for Edmonton where she met Gene. Albeit, Helene came from a much smaller family — she was number five of only six children.

In 1977, when Ron was twelve, his father announced to the family that Imperial Oil had transferred him to Toronto so the family had to pack up and head east. Much later in life, father confided to son that he’d actually requested the trade. Perhaps Gene just never liked Edmonton all that much or, as Ron reflects now, it was that his father thought Toronto would offer more opportunities for his children as they grew up.

Before coming to California for this winter, I had lunch with Ron at a lovely spot on Avenue Road in Toronto called Cafe Landwer and he spoke about his childhood in nothing but happy terms, blessed to be in a loving, encouraging family where it was assumed all three children would go to university. He was an academic kid who also loved sports and attended the Catholic all-boys Brebeuf College School. After graduation he stayed at home while studying engineering at the University of Toronto. Though he began in chemical engineering he switched to industrial after first year. A couple of things emerged from his last year in the program that lay the groundwork for that openness and, to a degree, randomness from which Ron has built a life that can only be described as full and successful.

The first is that he wrote his fourth year Industrial Engineering thesis on Artificial Intelligence, a choice not at all remarkable in and of itself. The second is that when it came time to meet with campus recruiters, he accepted a position with Andersen Consulting, the first job offered (actually the only one he applied for). What was so compelling about them? “I thought being a consultant would be a cool job,” Ron said. And that AI thesis? Because of the paper the firm looked at him as something of an expert and he suddenly found himself as the “AI guy”. With no real plan coming out of school, no real focus other than to start working, his career was set in motion with a few more curves and swerves always going in a positive direction.

In quick succession, from 1987 to 1992, Ron leveraged the “expertise” by actually learning what he needed to know, moving on from Andersen to become a “Principal Knowledge Engineer” at AI Corporation and then partnering with a colleague to start his own business, Altera Systems Corporation. For Ron Dizy, that last move would change everything. During this same period of time the Ontario Teachers’ Pension Plan was created as an arms-length entity from the government to manage and invest the vast amount of teacher’s pension money. Claude Lamoureux was hired as the first President and CEO. This new entity not only modernized its investment strategies it also modernized its IT infrastructure.

As Ron explained to me, “Al Reesor, the Chief Information Officer, turned his sights on fixing the actual pension administration system. He bought a system from AICorp to do it but lacked anyone on the team who really knew how to use it. I was getting a bit frustrated at AICorp because I felt we weren’t really helping our customers be truly successful with the platform. A colleague and I saw an opportunity at Teachers’ Pension because they really were trying to do something at scale, in production — and we had the skills. We won the job just because we knew how to do what Reesor needed done. Honestly, we signed the Teachers’ Pension deal with our own company before we resigned from AICorp. Reesor was very fair to us and willing to spend money to assure success.”

At twenty-eight years old Ron launched himself into an extraordinary, life/business-learning-experience not because of the contract, per se, but what eventually unfolded. It took a couple of years to build the administrative system and they did all manner of testing along the way. “But, as a last check,” Ron said, “we randomly selected a number of existing pensions in pay and ran them through our system. We expected everything to work fine because we had done a lot of testing — but we got different results. My immediate thought was that we had some sort of error in our system but very quickly the testing experts confirmed that our system was right.”

What did that mean?

“The existing pension calculation system was wrong!” One of the largest government pension plans in the country had a range of systemic errors. Shockingly, two-thirds of the pensions were being wrongly calculated and paid out, evenly divided between those overpaid and those underpaid. “I don’t remember when Claude, the CEO, first heard about it,” Ron said “but I remember quite vividly the meeting where we discussed what to do about it.” No kidding!

After Ron and his team framed the issue, Claude asked his senior executive team for ideas of what to do. Some advocated to “let sleeping dogs lie” and fix the problem going forward or, if they made any adjustments, only worry about the underpayments. Others were adamant about the corporation’s fiduciary responsibilities and all errors needed to be addressed. To do that, it meant embarking on a huge project, which would take a great deal of time and money.

When everyone finished the CEO spoke and Ron says, “The decision was made on the spot, entirely on principle. I have remembered that the rest of my life. Claude said, ‘We were supposed to do one thing — pay pensions. And we didn’t do it right. We fix it.’”

The process ended up taking close to four years. It began with a Teachers’ Pension Plan employee in charge of the project but the person was eventually removed and Ron was asked to take the lead. “It was after that, in early 1998, that I ended up joining Teachers’ as an employee. I remember a one-on-one with Claude, probably in late 1997, in which he asked me if I would consider joining Teachers’ in the investment part of the organization. I told him that I didn’t think I had the required background: no MBA, just an engineer, and no real investment experience would seem to preclude a career in investments. Claude said ‘I have all these MBA spreadsheet jockeys. And they are smart. But they don’t really understand business or how to get things done. You do. I am not sure where you fit best, but let’s explore that.’”

Ron was sent off on a series of meetings with the heads of all the asset classes who generally agreed with his self-assessment of his investment capabilities — but the CEO wanted him on board so they gave him a chance. The randomness that started with a fourth year university thesis took him on a road he’d never envisioned, however he stayed curious, put in the effort, and took advantage. He soared up the learning curve in the investment business so quickly he ended up developing a quantitative investment program, running a portfolio based on that program, and helped launch Ontario Teacher’s venture capital initiative. All that in a matter of thirty months, after which he left to become a partner at the venture capital firm Celtic House.

As I’ve written, I met Ron when he was head of Enbala, a firm he joined after leaving Celtic House with no previous experience in the energy business. When I came to know much more about Ron through interviewing him for this profile — like the fact he learned the investment business and turned himself into a venture capitalist in only two and a half years — I started to think about how credible he was heading up Enbala. How did he gain so much understanding that he could represent many cutting-edge technology businesses in discussions with how the Ontario government could modernize, if not revolutionize, the electric generating and distribution system? Foremost, he answered, is that he comes “from that place of curiosity. Why does it work that way? What historically drove that? Who were the actors…”. Second, there is no substitution for hard work. To learn and be successful in those roles required long work days and working most weekends.

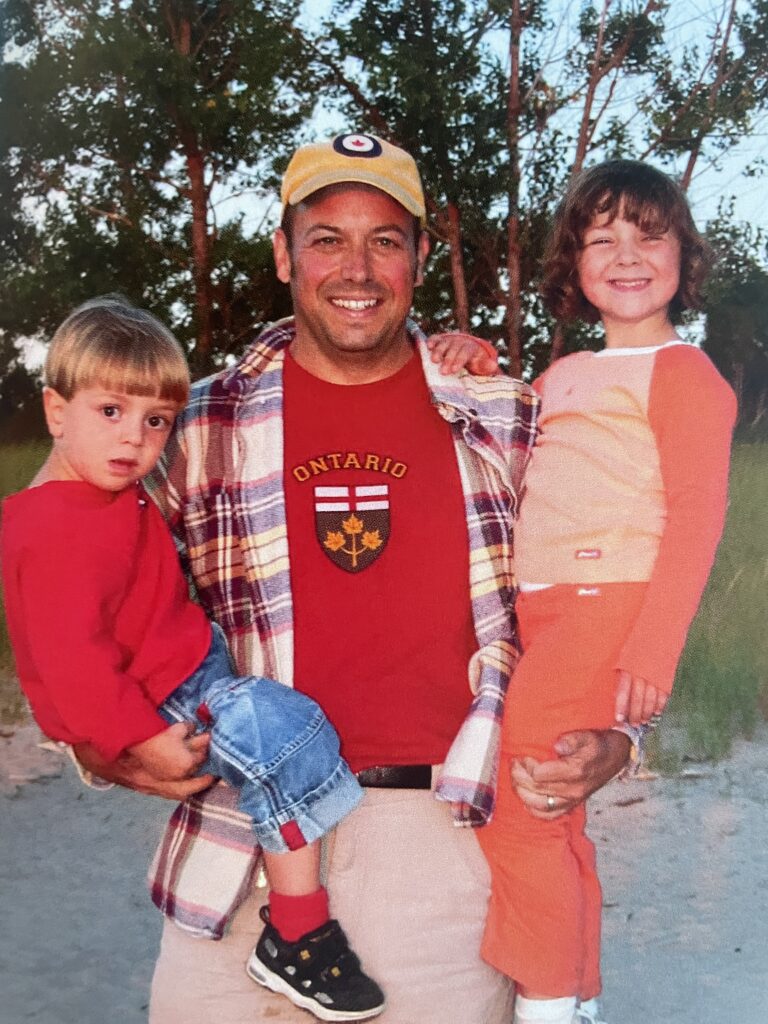

During this time he met and married Jo Ann and they had two children. Which brings up the question of “life-work balance”. Ron and Jo Ann have had a great marriage, one that he openly discusses with his children by telling them that the key is having shared values. But the marriage of two people in demanding jobs can cause a strain. Flagged as a high potential employee at Scotiabank, Jo Ann was building her own career. After their daughter was born, she went back to work and they used a combination of daycare and nanny time, but found it very hard. “We both had demanding jobs that were difficult to predict and often had end-of-day meetings etc. That left us in the difficult position of one of us having to bail, when we really didn’t want to — and created a bit of friction. After Max, Jo Ann decided that she wanted to stay home with the kids, at least until they were in school. It really was her decision, and we felt fortunate that we could make that decision. I know she doesn’t regret it at all.” That said, Ron is honest in sharing that his kids still say he works too much even though he’s stopped on most weekends. Jo Ann supported the many dinners and extensive business travel by taking care of the kids, the activities and the homework for years — and then built a couple of businesses on her own. In the end, they see themselves as a strong team.

While Ron always travelled a fair amount for business, it became more pronounced when Ron decided to leave Enbala and join the MaRS Discovery District as the Managing Director, Advanced Energy Centre. You can click here to learn about MaRS but the organization bills themselves as “the world’s largest urban innovation hub in Toronto that supports startups in the health, cleantech, fintech, and enterprise sectors.” Ron’s combination of energy and venture capital expertise made him a perfect hire. As for why he made the change, opting for an entirely different kind of role, he reflected on himself by saying that when people have occasionally asked him for career advice he answers, “I feel that it is very difficult to plan a career. Rather, it is important to make sure that you are always learning, and then be open to change (that last part can be hard). It is a bit more of a fatalistic approach to career planning. If you are not learning (kind of challenged) you have to find a way to change your job. Earlier in my career, I felt it took two or so years to master a role… you needed to find something different after that. Later — in roles like being a CEO — the 2 year rule kind of went out the window.”

Ron Dizy: infinitely curious, always learning, always wanting to be challenged.

The Advanced Energy Centre (AEC) had been provided a one time, $5 million grant from the Ministry of Energy and told to create a sustainable business model. With Ron’s venture capital background it was like a startup — after initial funding, AEC had to find a way to generate positive cash flow. One of their key offerings was a “game” called Newtonian Shift that they licensed from a Dutch firm. Intended for utilities and governments, Newtonian Shift is a facilitated role-playing simulation that allows players to experience decades of energy transition in one day. All the talk about Climate Change boils down to how we create and utilize energy. To maintain our economy while greatly reducing carbon emissions requires extraordinary change. For Ron, during his time at AEC, the “mission was always international — the idea being that if we could form relationships and help advance the adoption of advanced energy technologies internationally, that would be good for Canadian companies. Drive demand but also have a seat at the table.”

The international focus took Ron to a wide variety of places, from Colombia and Chile in South America, to China, India and Nepal in South-East Asia. I asked him, of all the international work he did, what stood out the most.

“I think the most memorable experience was with a client we had in Chile, called EEPA (Empresa Electrica Puente Alto), a small utility located in the outskirts of Santiago. The CEO was Carlos Bachler – maybe my favourite utility CEO ever. He had a sleeve tattoo from his fingers to his neck. His family had owned the utility for many years, and he was never interested in it. Instead, he went to Fiji and Vancouver, and trained to be a chef. When his father died, somewhat suddenly, he was asked to come back to Chile to help sell the utility (no one else in the family was interested in running it). But as he started looking into the business, he felt that there was a really strong core to it and persuaded his family to keep it. He would run it. He turned out to be a very instinctive and talented leader, and the company flourished under his leadership. He put his employees and customers first, including high quality meals served at head office, and an emphasis on fitness and mental health. He also pushed for change in the regulatory environment so he could do things like install prepaid meters for his customers (his service area was generally low income), rather than constantly sending trucks for disconnections for non-payment.

“Our message of change really resonated with Carlos, and we did a lot of work with his utility, including hosting a large Newtonian Shift that included representation from many of the other groups in the Chilean electricity sector (renewables associations, large customers, the regulator, government, etc) — that was a great success.”

In the end, though, remaking the energy sector is no small feat. “The challenge with all this stuff is even with willingness, it just takes a lot of time to drive change — and that is no different in Chile than in Canada. The frustration, over time, was just how long it really takes. That drove my desire to return to the private sector, first with Spark Power, now with Red Jar.”

With Spark Power, Ron returned to a hands-on operational role as Chief Commercial Officer but less than two years in, the principals of the company formed Red Jar, a new venture capital firm, and asked Ron to join them. All these changes over a three-decade career of consulting, venture capital and operational leadership, led me to email Ron and ask whether his move back to venture capital meshed with not only his sense of curiousness but also an ability to drive some measurable success in private enterprise.

“You know Ed,” he replied, “I have thought about this question before. I have enjoyed and appreciated and learned in all of the roles I’ve had. It is hard to say that one is any better than any other. I feel fortunate to have had the range of opportunities and experiences that I did.

“I think the various roles just give you different things. I enjoyed being in venture capital the first time around — what’s not to like?! You hand out money, get to pick who you work with, and you don’t have day-to-day responsibilities! But then you miss the amount of insight and control you get from being in an operating role — and I do like that! The MaRS role was fascinating — it was like being an insider in so many businesses. I felt that utility and government executives were so much more willing to share what they were thinking in that role … and provided me with so much more insight into WHY the energy sector works like it does.

“At Red Jar, I almost have the best of both worlds. We are investing — but we are also starting companies. I am now the CEO of Red Jar Digital Infrastructure and we have raised venture capital in that company so I really am in an operating role again. But, we are also taking a broader view and have 12-15 investments … it is fun!”

Daughter Kyra is in third year university, learning to be a teacher (but with a serious entrepreneurial bent: she runs a very successful swim school every summer) and son Max is in the first cohort of the Mechatronics Engineering program at Queens — following in Ron’s footsteps. By all accounts, much of Ron’s travel lately has leaned to more personal vacation with Jo Ann although Covid has dampened that, as with everyone else. As for Ron’s future, what I’m confident in is that he’ll stay curious. Beyond that, I’m guessing there are a few more surprises in store. I was going to ask Ron what he thought those might be but, if he knew, then they wouldn’t be surprises, now would they.

Next up is…the end. Or at least a hiatus. I’m a third of the way through writing a new novel and that is where I want to focus for the coming months.

I started publishing Profiles From The Bright Side Of The Road in November, 2019, and in almost two-and-a-half years I’ve published thirty separate pieces. A few have focused on family, while some on friends who I’ve known for a long time and others on friends more recently met. I’ve Profiled people who embody different facets within their lives, combined into their being, and taken together that covers a long list: poet, artist, photographer, father, mother, actor, environmentalist, novelist, lawyer, editor, investment advisor, screenwriter, letter carrier, set designer, philosopher, director, venture capitalist, musician, advertising creative, journalist, teacher, entrepreneur, woodworker, costume designer, engineer, charity fundraiser — and many who write for the sake of writing. These people span from Los Angeles to Toronto to Halifax to St. John’s to Biche, Trinidad. As I reflect back I realize how fortunate I am to know so many diverse and wonderful people on my personal journey to the bright side of the road.

If I end up coming back with more Profiles, I hope you come back too.

4 Comments

Leave a Reply to Giselle Amann Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

I just loved reading this beautifully written piece about your remarkable friend and his most interesting life story. Your profiles have been a welcome respite in this sad old world!! Bright side of the street for sure! Your hard work in composing these profiles remain a literary tribute to you as well as those profiled. Your writing adventure has led you to many literary endeavours and we look forward to the literary delights you will undoubtedly dish up for us all in the future. Many thanks!!!!!

Thanks, Eddie, for this tribute to another life colleague.

I knew Ron when he worked at Teachers’. The whole “recal” project was intense. I remember being asked to call some pensioners to give them a “heads up” that a letter would be coming and that it was real. These were people who would be given a retroactive payment, some over $100,000. Ron works hard and plays hard, as I also recollect having some tequilas with him at the Chicken Deli way back when.

Wished I’d interviewed you! Tequila at the Chicken Deli sounds like one helluva story!